Medical offices today face new challenges to profitability and sustainability, especially in the wake of the recent COVID-19 public health emergency. Faced with declining reimbursement rates, medical practices are pressured not only to increase efficiency in care delivery, but to reduce the expenses associated with billing, submitting claims, and getting paid. These challenges, coupled with a high turnover for on-staff billing personnel are important reasons to focus on your total revenue cycle process or consider outsourcing to a professional RCM provider.

Revenue cycle management (rcm) defined:

Revenue Cycle Management or RCM is one of the many acronyms that we hear everyday. But what exactly is revenue cycle management and how is it different than or an improvement on traditional medical billing?

Revenue cycle management (RCM) is defined as the process that manages claims processing, payment, and revenue generation; and often entails the use of automation in the claims review and submission process.

The revenue cycle starts at the time the patient's appointment is made and ends when the charges for the visit have been paid in full, both from the payer and the patient.

The success or failure of a healthy revenue cycle is solely dependent on what happens between in the scheduling of the appointment until the time that the bill is fully paid,. both by insurance and or the patient.

Key Difference Between RCM and Medical Billing

The key benefit of revenue cycle management over traditional medical billing is an aggressive claim denial and claim rejection process. Whereby your RCM team relentlessly follows up on every denied and underpaid claim.

In a busy medical practice billing staffs are typically overwhelmed with day to day billing and posting activities. The time and effort required to track down every underpaid or denied claim just isn't available resulting in providers not being fully paid for services rendered.

Key Performance Indicators or KPI

One of the most important metrics in evaluating your practices financial health is Days in A/R or day in accounts receivable. Essentially the average number of days that it takes a claim to be fully paid.

Nationally the number of days in A/R has been steadily increasing since the early 2000's. Outsourcing your medical billing can be a great strategy to reduce your practices days in A/R.

top benefits of working with an RCM partner

#1 better cash flow

Revenue cycle management is the core of a practice’s overall financial health—the quicker you get paid, the healthier your practices business operations. If your days in A/R are greater than 40, this is a prime target to focus on and improve. Payment delays directly impact your cash flow. Minimizing days in A/R and claim denials are key to maximizing your revenue.

#2 fewer Claim Denials

A healthy revenue cycle starts with filing clean claims with payers - claims that meet all of their ever changing requirements. Usually office billing staffs become aware of a change only after a claim has been rejected or denied. RCM providers keep abreast of changing rules to ensure extremely high first pass rates of your claims. Clean claims = faster cash flow

#3 work all denied and underpaid claims

Ensuring that fewer claims are denied upfront is an important first step as we've seen above. However, payers will still deny some claims and underpay others. A busy billing staff typically doesn't have time to work all of them. However an outsourced RCM service provider has large staffs dedicated to aggressively following up and working these to ensure your paid every dollar due.

#4 Timely Claim Submission

Lack of timely filing is a immediate and surefire way to have claims denied resulting in lost revenue. An. RCM outsourced partner will ensure that all claims are submitted as fast as possible resulting in no claims not paid for lack of timely filing.

#5 fewer billing errors

The vast array of different payer rules and complexity of medical billing in general result in opportunities for medical billing mistakes and errors. Every step in the revenue cycle from eligibility, to submission, payment posting and statement generation has the potential for errors. Working with a professional RCM provider will result in fewer errors, translating into faster cash flow.

#6 Lower Costs

Working with a proven and experienced RCM provider is an investment in your practices financial health. Maintaining an office billing staff can be expensive in terms of salary, turn over, training new hires and dealing with vacation, sick time etc. A professional RCM team never needs retraining, never takes a day off or shows up late. Investing in RCM = big returns

#6 Improved Patient Care and happier staff

Medical billing is hard. Complex and changing rules lead to poor financial results and excessive time away from what's important - patient care. Outsourcing your medical billing to an RCM partner allows providers and staff to focus solely on delivering exceptional patient care.

#7 Increase Revenue without Disruption

Changing technology can be a costly, disruptive process, affecting everyone and everything in your practice. Choose and RCM partner that works with your existing software to minimize or eliminate disruptions and chaos

Conclusion:

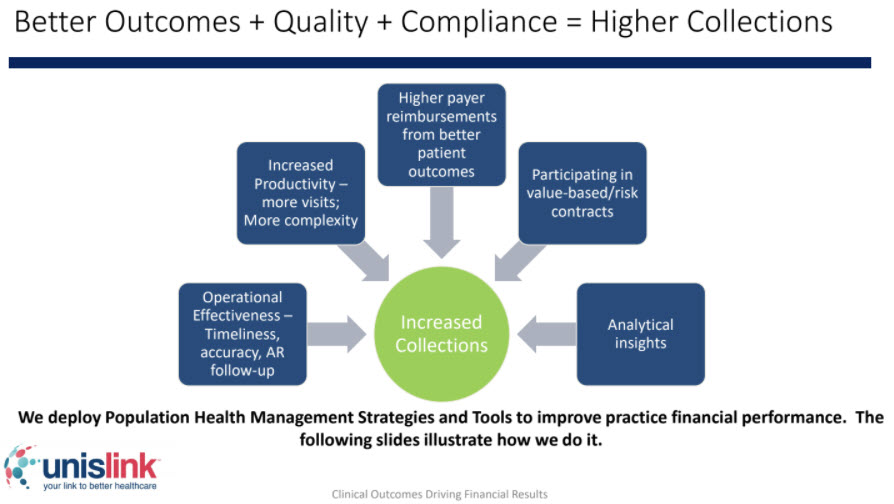

You earned the money—now achieve a faster, more efficient revenue cycle. Work with a trusted RCM partner who is backed by a record of experience and success. AVS Medical's RCM partner, UnisLink team serves approximately 1,100 providers for RCM services and over 8000 providers using their population health/eCQM tools.