Preparing For MIPS 2024

Get ready for MIPS 2024 with these essential tips and strategies to maximize your performance and succeed in the program.

4 min read

AVS Medical : Sep 5, 2023 9:40:20 AM

On July 13, the Centers for Medicare & Medicaid Services (CMS) released a 1,920-page proposed rule that would update payment policies and programs regarding Medicare payments to physicians and other providers under the Physician Fee Schedule (PFS) on or after January 1, 2024. Every year, industry stakeholders anticipate the release of this annual regulation because it updates the rules governing Medicare’s value-based programs and physician payment system.

The proposed rule is open for public comment through September 11. Following the close of the public comment period, CMS will issue a final rule in late October or early November ahead of the January 1, 2024 implementation. While the lengthy rule includes numerous provisions, most notably it would:

Unfortunately, the rule proposes a 2024 PFS conversion factor of $32.75, a decrease of 3.4 percent from the 2023 conversion factor of $33.89.This decrease reflects: the expiration of the 2.5 percent increase for 2023 included in a December 2022 law, the institution of a 1.25 percent increase for 2024 included in that same December 2022 law, and a 2.2 percent decrease resulting from Medicare’s statutory budget neutrality policies and the proposed addition of new codes and code values in 2024.As in the past several years, physician trade and advocacy associations are already lobbying Congress to reverse this cut.In response, some members of Congress have introduced legislation to permanently link these annual updates to a measure of inflation, but it’ll likely be difficult for Congress to gather the political support and find the spending “offsets” needed to pay for that legislation this year.

In its 2021 physician fee schedule rule, CMS finalized a policy to begin paying $16 per visit for a new add-on code (G2211) for “inherently complex evaluation and management (E/M) visits” starting January 1, 2021.Because annual Medicare payment adjustments have to be budget-neutral, this increase in payment for office visits and (mostly) primary care providers was set to trigger a 10 percent payment cut to Medicare’s conversion factor in January 2021.However, in response to heavy lobbying from specialty physician associations, in December 2020 Congress passed a law to prohibit CMS from making payments for code G2211 for three years (from January 1, 2021 until January 1, 2024).In this new rule, CMS has re-introduced and re-proposed G2211 to become “active” for payment in 2024.CMS also proposed some minor changes for the new code and lowered its cost and utilization assumptions, now predicting the code will be billed with only half of all outpatient office E/M visits (down from its prediction of nearly all visits in 2021).Even so, this new code should offer primary care providers a rare opportunity to increase reimbursement from Medicare.

In an extremely significant reversal from its long-standing previous policy, CMS proposed to permanently establish payment parity between Medicare in-person outpatient office visits and Medicare telehealth service visits when a patient is physically present at their home. For a level three established patient E/M telehealth service visit, this would boost proposed 2024 Medicare reimbursement from $64 (the facility rate) to $89 (the non-facility rate).Although this payment parity for Medicare telehealth visits has been in place since March 2020 (originally tied to HHS’s public health emergency (PHE) but since extended by CMS until the end of 2023), this policy was set to expire at the end of 2023.Elsewhere in the rule, CMS proposed to implement provisions of a December 2022 law extending through December 2024 key Medicare telehealth policies that were in effect during the PHE, including geographic and physical location waivers and the addition of community health centers as covered telehealth service providers.

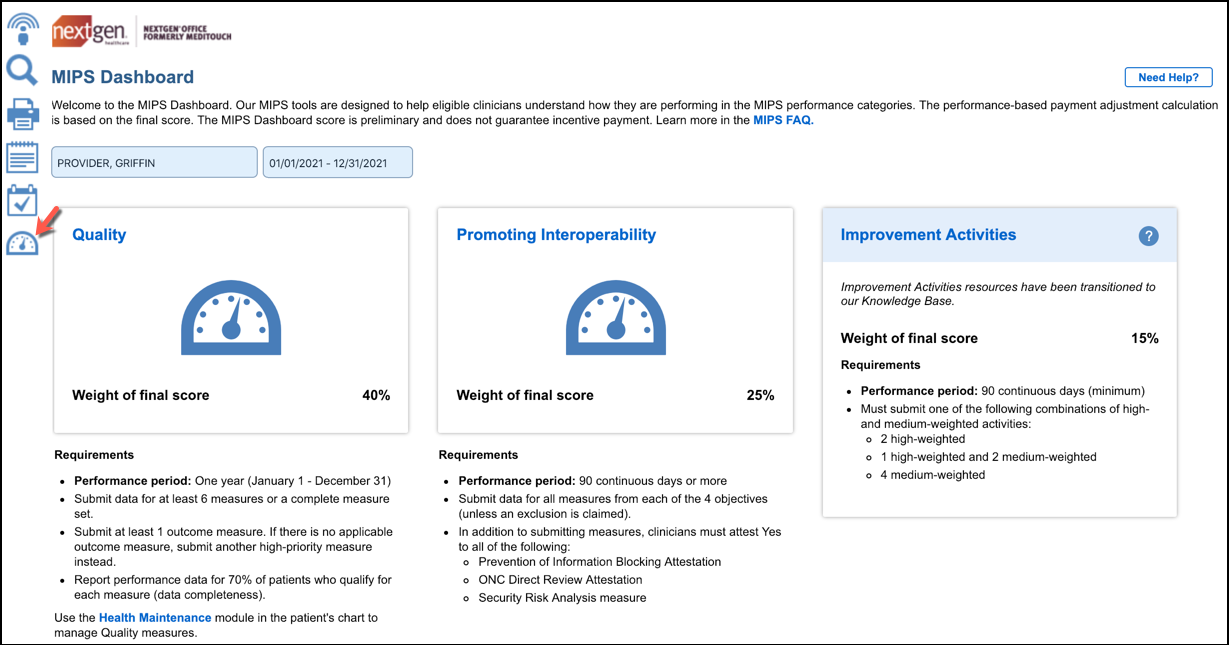

In 2019, CMS added the following clinician “types” to its list of Merit Based Incentive Payment System (MIPS) eligible clinicians to whom MIPS applies: physical therapists, occupational therapists, qualified speech-language pathologists, qualified audiologists, registered dieticians, and clinical psychologists.However, starting in 2019, CMS also exempted these clinician types from having to report the promoting interoperability performance category (which measures certified EHR use).In 2024, CMS proposes to remove this exclusion, thus instituting a new requirement for these clinician types to utilize certified EHRs for the first time (assuming another exclusion such as the low volume threshold or small practice exemption doesn’t apply).Separately, CMS proposed to increase the 2024 promoting interoperability performance category performance or data collection period for all clinician types from 90 days to 180 days.

In its 2023 final physician fee schedule rule released November 2022, CMS finalized a series of significant changes to Medicare’s largest ACO program, the Shared Savings Program (MSSP).Some of the more minor changes included in that rule went into effect in 2023, while the most significant changes (Including the availability of amended participation options, a revised financial benchmark methodology, and the availability of advance shared savings payments to certain ACOs) will go into effect for the first time in 2024.In this 2024 proposed rule, CMS proposed a more limited set of changes to the MSSP that (according to CMS) are intended to be, “incremental refinements to the broader changes finalized in the CY 2023 PFS final rule.”Proposed changes for 2024 include: establishing a new Medicare Clinical Quality Measure collection type for ACOs reporting quality measures under the Alternative Payment Model (APM) Performance Pathway (APP); making additional changes to the financial benchmark methodology in support of ACOs’ continued participation in the program; and updating CMS’s Hierarchical Condition Category (HCC) risk adjustment methodology for ACOs to align with changes recently made in its Medicare Advantage program. As with last year’s rule, many of these proposed changes were made in response to feedback from industry stakeholders, who applauded the proposals.

In addition to these changes, the nearly 2,000-page rule proposes many other important policy updates. Those interested in further details can access the full rule here, CMS’s press release here, and fact sheet here.

Interested In Cloud Based Software that can help you successfully meet MIPS?

Get ready for MIPS 2024 with these essential tips and strategies to maximize your performance and succeed in the program.

NextGen Office EHR/PM is now interfaced directly to CMS’s QPP site. Our latest release features an interface to the CMS Quality Payment Program or...

The Centers for Medicare and Medicaid (CMS), in partnership with the consulting group Guidehouse, is ramping up its data validation and audit (DVA)...